Open your bank to the future with our Open Finance solution

In the journey that goes from contemplating your country’s regulation to taking a leap to a true model of Banking as a Service (BaaS), IC Open Finance allows banks to step strongly in the development of new businesses, leveraging a global community of over 11 thousand developers and over 500 available APIs.

The technology we offer together with Tesobe, the company behind the Open Open Bank Project (OBP), was developed to provide a superior experience to developers of financial solutions, and unmatchable access to the tools and documentation to increase productivity. We deliver a world of unprecedented opportunities to the Banks connected to our ecosystem.

Benefits of deploying Open Finance in your Bank:

- Development of new businesses with no need to invest in staff, marketing, or branches.

- Expansion of their market niches as a “soft” brand for the ecosystem’s FinTech, without affecting the main brand positioning of the Bank.

- Better customer experience offering through the access to new capabilities and technologies.

- Being ALWAYS up to date with the country’s regulatory provisions (Our commitment is deploying those changes required by governments in a few weeks).

- Incorporation of the financial industry standards to achieve connectivity and maintainability, scaling its own development.

Objectives of Open Finance:

Reimagining the bank through an Apification Strategy:

The world’s largest technology players are increasingly becoming stronger in the financial world and banks are increasingly becoming stronger in the tech world

You can now open your bank to an ecosystem that will allow you to innovate, without investing in innovation, offering the banking capabilities to be consumed and executed through third-party services.

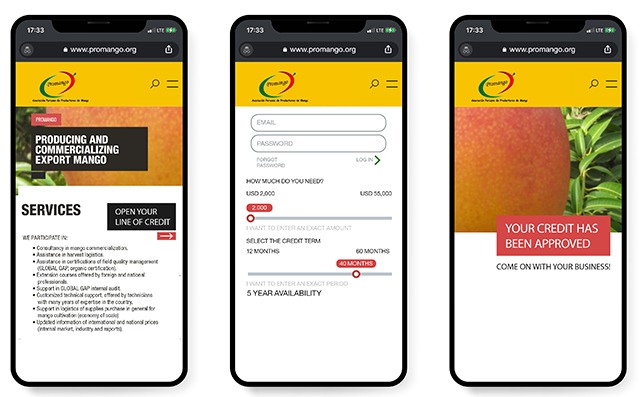

Concrete usage examples of Open Finance:

- Purchase of any type of product or service, with bank issued credits, with no need to leave the commercial environment where the user is.

- Possibility of providing credits to SMEs together with organizations or institutions that gather them together in one sector.

Some of our available APIs

Accounts

Access the list of user accounts and the account information, such as the balance.

Counterparties

Access payers and beneficiaries of an account, including metadata, such as alias, tags, logos, and home pages.

Onboarding and KYC

Origination of users, customers, and accounts. Access documents, means and status of KYC (Know Your Customer).

Payments and transaction requests

Initiate wires. See and confirm fees (according to PSD2).

Dynamic end points

Quickly create end points using Swagger/Open API specification files.

Minutes

Access the accounts’ history of transaction and metadata.

Branches, ATMs

Access the list of branches and ATMs of the specified bank, including the geolocation and the open schedule.

Webhooks

Enable meetings with clients, messages and videoconferences for KYC and CRM operations (It uses third-party video streaming).

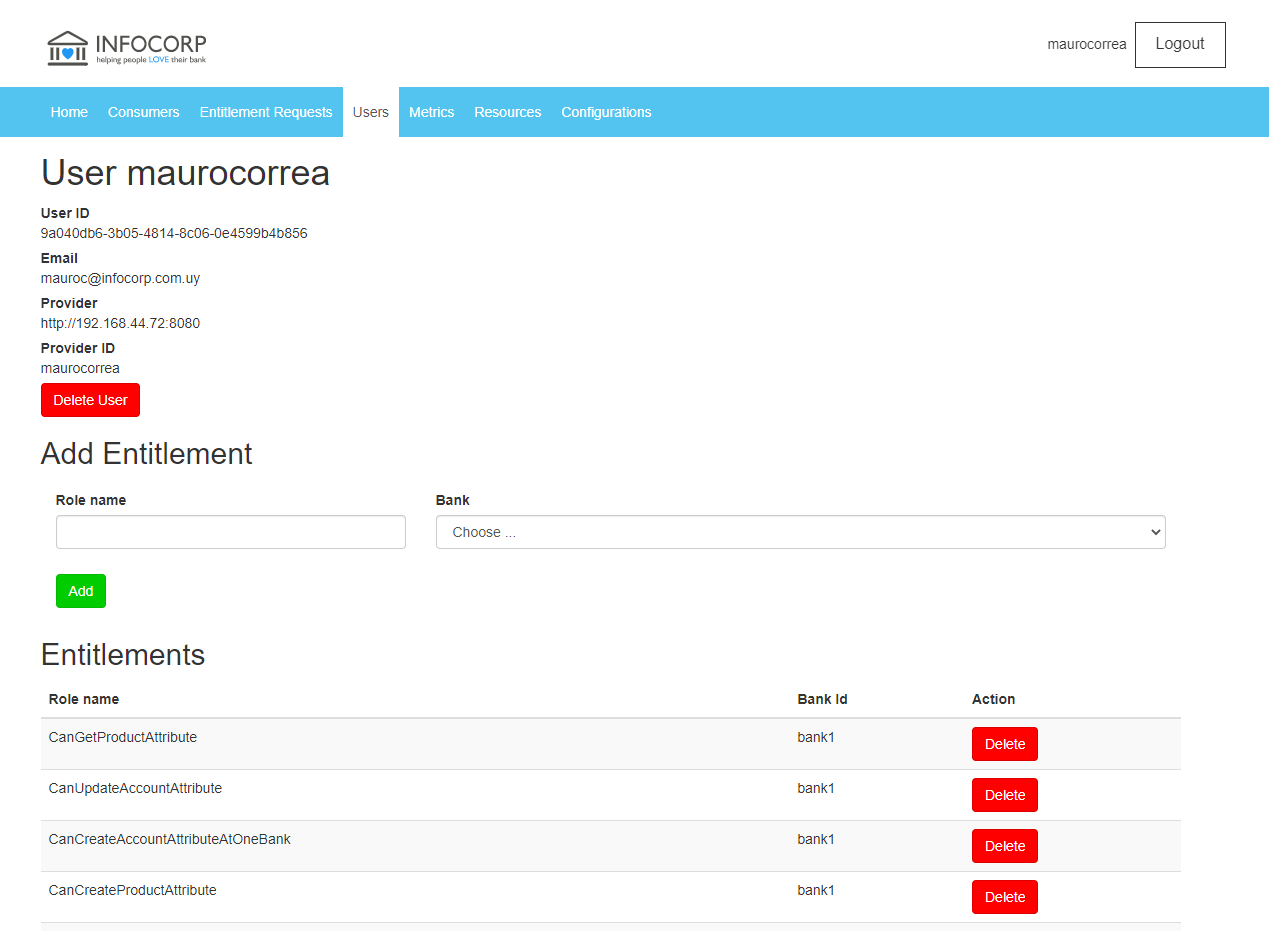

API roles, metrics, and documentation

Allow account holders to grant detailed access to users and third-party apps, obtain API metrics and documentation.

Search storage

Make advanced searches and statistic queries in data storage.

Metadata

Enrich transactions and counterparties with metadata that include geolocation, feedback, images, and tags (for example, expense category).

Real time information

Whether you have deployed the IC Banking platform or not, you can benefit from IC Open Finance and see the growth of new business units in real time through graphs.

Access control with security levels

Using IC Open Finance does not mean losing security. The solution is deployed behind the bank´s firewall, which guarantees the same security levels of current systems.

You can control the use of APIs through access control capacities and authentication of our OBP API Manager, and decide which APIs to expose and who to expose them to, or revoke accesses whenever you consider it necessary.