Experience Mobile First Love.

Experience Mobile First Love

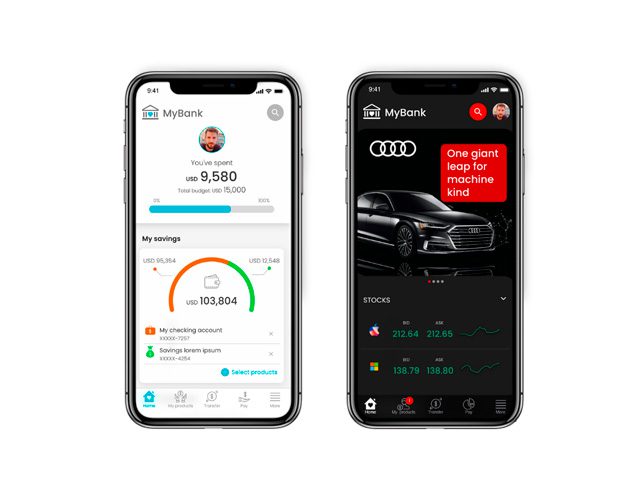

Our new Mobile Banking channel is designed to walk the user end-to-end in their customer journey with the Bank, so that they can use it as the only interaction channel. For the first time, customers will be able to have a banking experience from their perspective, language and needs, in an innovative way. This resulted in IC Mobile Banking being awarded as Best Of Show at Finovate Fall 2021, due to its innovation impact.

The Foundation of a Mobile First World

The mobile banking service is designed as the main channel, natively developed from scratch, with 100% of features and UX latest trends. In addition to o ffering the best user experience, our Digital Toolkit provides the bank with the possibility to customize and add value to the App, giving its innovation team freedom to create.

A fluent behavior adapted to the user’s behavior

We have created a new user-centered experience that evolves according to customers’ behavior patterns. A seamless experience that takes the best of the native smartphone experience and the banking experience.

Built-in differentiation capabilities at every level

The App provides an experience based on usage patterns and user characteristics. It is fed by AI models, which generate an experience that adapts, accompanies and advises the user in their day-to-day economic life, in an eff ortless way.

IC Digital Toolkit

IC Mobile Banking was designed on IC Digital Toolkit, a modern and open technological platform that allows third parties to generate visual components to create new financial services. Through the UIKit and Banking Components framework, the Bank will be able to create new widgets, extend the App to add new products, screens and features, and customize the App as required.

Open Bank Ecosystem

IC Digital Toolkit, together with the new Open Api connectivity layer, builds the foundations for the new interconnected business models demanded by customers.

Products & Services

- Individual and joint accounts

- Branch transfers

- ATM transfers

- One-step multiple transfers

- Cash advances

- Transfers between individual accounts, to the Bank, to other Banks and abroad

- Cardless withdrawals

- Credit line disbursements

- Service payments

- My favorite transactions

- Approvals

- Push Notifications

- Personal Finance Management