A bank that provides value to its customers is a bank that people will love.

People are not born knowing about finances and in general we do not receive formal education about this. We learn as the need arises and many times, we become confused as life gets more complicated. Our financial life —that began with a simple piggy bank— now has multiple accounts, cards, expenses and income sources. There is a growing need to provide people with tools to better manage their finances, while promoting savings and a better use of their budget. Those who manage to take on a leading role in this issue are those who will achieve better customer loyalty.

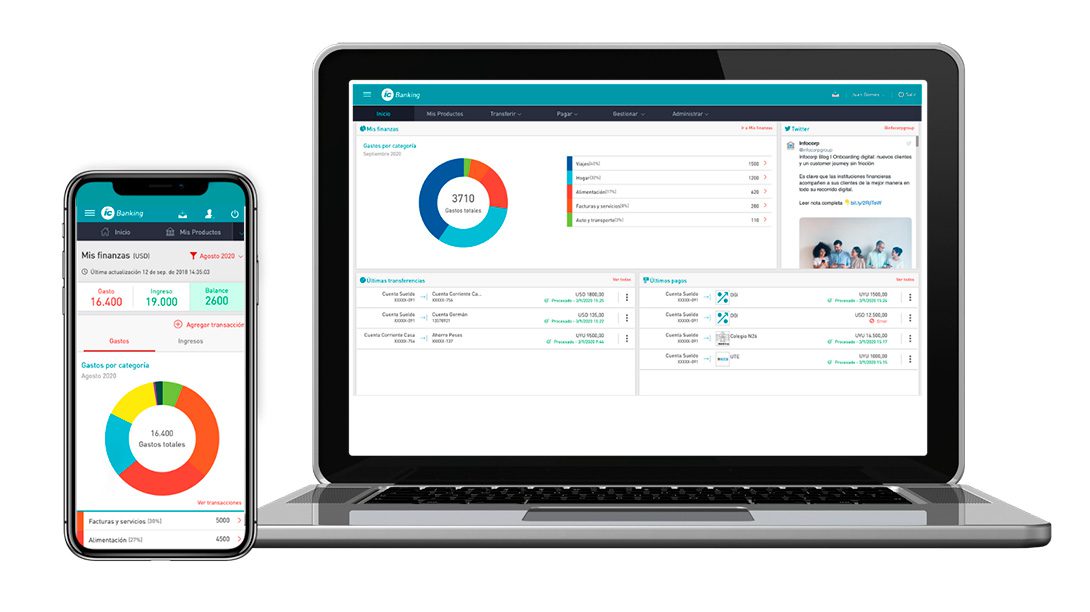

IC Personal Finance allows users to see their expenses and income classified by categories, to graphically see the evolution of their income and expenses over the months, as well as to propose a fixed monthly budget and savings goals.